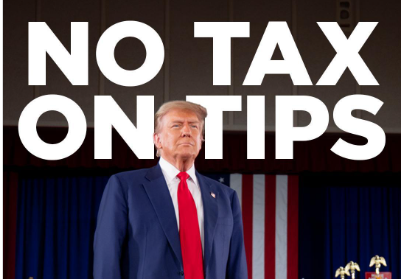

Tips are more than just a bonus for millions of American service workers; they are a vital source of income that helps fill the income gap caused by low hourly wages. Advocates see today’s congressional vote on whether to remove tip taxes as a much-needed financial relief for hardworking people, sparking optimism, discussion, and political scheming.

Bartenders, wait staff, and other tipped workers have endured years of hardship due to an unstable pay system. Tipping tax removal is viewed as a long-overdue reform that could enable employees to keep more of their hard-earned money. The question still stands, though, as the bill is up for a critical vote: Will it pass or is it just another showpiece with no actual legislative impact?

What the No Tax on Tips Vote Means for Service Workers

| Key Issue | Details |

|---|---|

| Legislation Type | Proposed exemption of tips from federal taxation |

| Current Status | Being debated in Congress, awaiting House and Senate approval |

| Who It Affects | Restaurant, hospitality, and service industry workers |

| Expected Benefits | Increased take-home pay, better financial stability |

| Potential Drawbacks | Loss of tax revenue, possible wage restructuring |

Follow the latest updates on the bill here

Why This Vote Might Change Everything

✔ A Lot of Service Employees Depend on Tips

Tips are not just extra cash for millions of Americans working in restaurants, bars, hotels, and salons; they are the main source of their paychecks. Many servers depend on the kindness of their patrons to make ends meet because their base pay is significantly less than the minimum wage.

✔ A Drive for Financial Equity

Proponents contend that tips are optional payments made by clients and do not count toward regular pay. Why should the government keep some of the tips that a hardworking server or bartender receives from a guest? Supporters think that workers should be the sole owners of this money.

✔ Economic Assistance for Low-Income Families

Financial planning is challenging because jobs in the service sector are frequently low-paying and have erratic schedules. Tipping tax elimination could significantly boost disposable income, enabling employees to save for emergencies, pay their bills, and attain financial stability.

Increasing Retention and Job Satisfaction

Offering tax-free tips could increase the appeal and sustainability of service jobs in a sector beset by high employee turnover, improving job performance and retention.

The Debate: Who Is Against the Tipping Tax Bill?

✔ Possible Government Revenue Loss

Tipping taxes, according to critics, generate billions of dollars in revenue that support vital public services. Legislators may need to find other ways to fill budget gaps if these taxes are eliminated.

✔ Danger of Wage Abuse

Some labor activists worry that employers might reduce base wages by using tax-free tips as a justification, placing even more financial burden on consumers. Given that employees can still receive tax-free tips, would bars and restaurants start to pay even less?

✔ Real Reform or Political Strategy?

The vote today, according to skeptics, is more about political show than real policy change. Rather than being a serious legislative attempt, some lawmakers view this measure as a rallying cry to win over working-class voters before the next elections.

✔ No Assurance of Senate Acceptance

The bill still needs to pass the Senate, where political differences could cause it to be stalled, changed, or blocked entirely, even if it passes the House.

The No Tax on Tips Movement: What Comes Next?

Although this vote is an important first step, change will not happen right away. Legislators will discuss the bill’s economic implications in the Senate if it passes the House. The President has the last say and must sign it into law if it passes both chambers.

✔ Possible Results:

Best Case: Millions of service workers will be able to keep all of their tips tax-free if the bill is approved by the House and Senate and becomes law.

Middle Ground: The bill is amended to include restrictions or phased implementation, but it still proceeds.

Worst Case: If the bill fails, the tipped workers’ current tax structure remains unaltered.