In the fiercely competitive global semiconductor market, Qualcomm (NASDAQ: QCOM) is one of the leading companies. Qualcomm has a history of using wireless technology, artificial intelligence, and 5G innovation to gauge the performance of the tech industry. However, investors are wondering if this is the right time to buy given the recent market volatility.

Qualcomm is at a turning point as the market for AI-powered gadgets, driverless cars, and next-generation wireless networks grows. Although some traders may become uneasy due to short-term volatility, the company’s long-term prospects are still very promising.

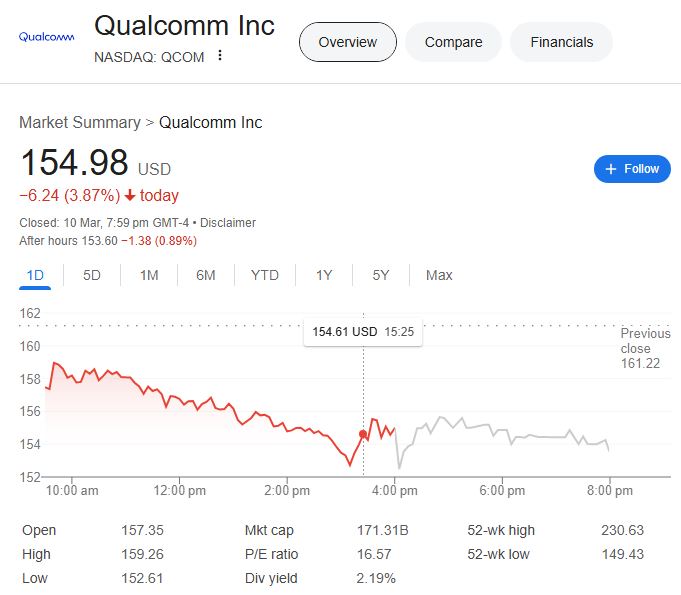

Qualcomm Share Price: Key Market Data (2024-2025)

| Metric | Value |

|---|---|

| Current Price | $154.98 (-3.87% Today) |

| 52-Week High | $230.63 |

| 52-Week Low | $149.43 |

| Market Cap | $171.31 Billion |

| P/E Ratio | 16.57 |

| Dividend Yield | 2.19% |

| 1-Year Target Price | $198.50 |

| Revenue (2023) | $35.82 Billion |

| CEO | Cristiano Amon |

| Official Website | Qualcomm Investor Relations |

What’s Fueling Qualcomm’s Market Momentum?

1. The 5G Revolution and Qualcomm’s Dominance

By supplying the chipsets and infrastructure that drive next-generation mobile devices, Qualcomm has played a significant role in influencing the direction of 5G connectivity. As more nations deploy 5G networks, there will likely be a sharp increase in demand for Qualcomm’s technology.

💡 Why It Matters:

✔️ As a market leader in 5G modems, Qualcomm’s intellectual property ensures steady revenue streams from device manufacturers.

✔️ Licensing agreements with Apple, Samsung, and other tech giants create a high-margin business model.

✔️ Growth in smart cities, IoT devices, and connected industries will further drive demand for Qualcomm’s connectivity solutions.

2. AI, Automotive, and Edge Computing: Qualcomm’s Next Frontier

Qualcomm is quickly entering edge computing, automotive technology, and AI-driven applications in addition to smartphones. The company‘s dedication to on-device automation and machine learning is demonstrated by its recent acquisition of Edge Impulse.

🚀 Strategic Moves:

✔️ Expanding AI-powered processing into self-driving vehicles, smart appliances, and industrial automation.

✔️ Investing in automotive chips, targeting autonomous driving, digital dashboards, and smart vehicle connectivity.

✔️ Advancing IoT solutions, creating a seamless, AI-driven ecosystem across industries.

By leveraging its leadership in wireless technology, Qualcomm is well-positioned to capture emerging opportunities in AI, IoT, and automotive sectors.

Is Qualcomm Stock Undervalued? Expert Insights

Qualcomm is currently trading at a discount to other semiconductor giants, which may make it a compelling investment opportunity. Despite robust revenue growth and a healthy dividend yield, its P/E ratio of 16.57 makes it significantly less expensive than NVIDIA (P/E: 45) or AMD (P/E: 34).

📊 Wall Street’s View on Qualcomm:

✔️ Bullish Analysts: Predict Qualcomm’s stock could rise above $200 in the next 12 months, fueled by 5G expansion and AI adoption.

✔️ Cautious Investors: Worry about Apple reducing its reliance on Qualcomm chips and competition from MediaTek.

✔️ Consensus Price Target: $198.50, implying a 28% upside from current levels.

For long-term investors, Qualcomm’s fundamentals remain strong, offering growth potential and dividend stability.

Challenges Qualcomm Must Overcome

🔴 1. U.S.-China Trade Tensions

China accounts for over 60% of Qualcomm’s revenue, and escalating trade restrictions could disrupt supply chains.

🔴 2. Smartphone Market Slowdown

Global smartphone sales have declined due to economic uncertainty, though Qualcomm’s diversification into AI and automotive helps offset risks.

🔴 3. Increased Competition

MediaTek is gaining traction in mid-range chipsets, and Apple is developing its own modems, which could limit Qualcomm’s future licensing revenue.

Despite these risks, Qualcomm’s innovative strategy and diversified portfolio provide strong long-term resilience.

Is Qualcomm Stock a Buy Right Now?

✅ Why You Should Invest:

✔️ 5G, AI, and IoT leadership position Qualcomm for long-term success.

✔️ Stable revenue, a strong dividend yield (2.19%), and an attractive valuation.

✔️ Significant upside potential based on analyst targets and future growth projections.

❌ Reasons to Hold Off:

❌ Short-term volatility and macroeconomic risks could impact performance.

❌ Ongoing competition and trade uncertainties may create headwinds.

📢 Final Verdict: If you’re a long-term investor looking for a strong mix of value, growth, and dividends, Qualcomm remains one of the best semiconductor stocks to own.

Looking Ahead: What’s Next for Qualcomm?

🚀 Major Trends That Could Propel Qualcomm’s Future:

✔️ AI-powered mobile processors integrated into edge computing and smart devices.

✔️ Self-driving and connected car innovations powered by Qualcomm’s automotive chips.

✔️ Metaverse and extended reality (XR) expansion, leveraging Qualcomm’s Snapdragon XR platforms.

✔️ Global 6G development, positioning Qualcomm as a key infrastructure provider.

With a powerful patent portfolio, strong leadership, and breakthrough innovations, Qualcomm remains a top contender in the tech industry.

Final Thoughts: Buy the Dip or Stay Cautious?

Qualcomm is a good long-term investment option because of its growth potential and cheap stock price. The company’s solid fundamentals make it a buy-and-hold option for investors with a long-term outlook, even though short-term headwinds may cause volatility.