For many years, EQT AB has dominated the global investment scene by exhibiting flexibility and resilience in the face of fluctuating economic cycles. With a strong portfolio that includes real estate, infrastructure, and private equity, EQT has developed an investment approach that strikes a balance between stability and innovation, guaranteeing long-term growth.

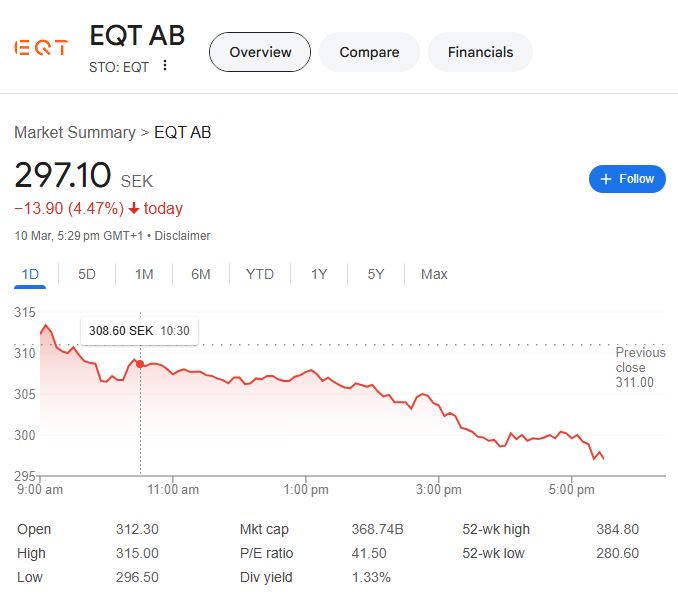

The share price of EQT AB is currently trading at 297.10 SEK as of March 10, 2025, a decrease of 4.47% from the previous trading session. Although this might worry short-term investors, experienced analysts understand that these kinds of swings are a natural part of the stock market. The question still stands: should investors be cautious or does this dip indicate a buying opportunity?

EQT AB: Key Company Information

| Attribute | Details |

|---|---|

| Founded | 1994 |

| Headquarters | Stockholm, Sweden |

| Industry | Investment Management |

| Assets Under Management | €210 billion (2022) |

| Global Reach | Europe, North America, Asia |

| Current CEO | Christian Sinding |

| Incoming CEO (May 2025) | Per Franzén |

| 52-Week High | 384.80 SEK |

| 52-Week Low | 280.60 SEK |

The Market Position of EQT: A Powerhouse in International Investment

EQT’s reputation as a highly effective and strategically astute investment firm has been strengthened by the substantial expansion of its investment footprint over the last ten years. Its diverse portfolio, which includes sustainable infrastructure projects and high-growth technology companies, has proven remarkably effective in both capitalizing on new opportunities and mitigating market downturns.

EQT’s dedication to long-term value creation as opposed to short-term gains is one of its primary differentiators. EQT maximizes asset performance by utilizing AI-driven insights and sophisticated data analytics, guaranteeing investors incredibly long-lasting returns. The company has benefited from its emphasis on sustainability and innovation, particularly as institutional investors give more weight to ESG (Environmental, Social, and Governance) considerations when making investment choices.

Why Has the Share Price of EQT AB Dropped?

Even though EQT AB is still a formidable competitor in the world’s financial markets, a number of important factors have contributed to its recent share price decline:

- Macroeconomic Uncertainty: A cautious investor attitude brought on by rising interest rates and geopolitical tensions has affected equity valuations in a number of industries.

- Market rotation: Short-term sell-offs in growth-focused investment firms like EQT have been exacerbated by investors moving their money from high-valuation stocks into defensive assets.

- Leadership Transition: Reactions to the news that Per Franzén will take over as CEO in May 2025 have been conflicting. Even though Franzén is well-liked, initial uncertainty is frequently caused by changes in leadership.

- Long-term investors see EQT’s solid fundamentals as a sign of future resilience in spite of these challenges.

Will EQT AB Have a Bullish or Bearish Future?

A number of indicators point to EQT AB’s significant upside potential for investors:

- Increasing Investment Portfolio: In order to take advantage of especially creative future prospects, EQT is aggressively diversifying into high-growth industries, especially artificial intelligence, fintech, and renewable energy.

- Sustainable Investment Strategies: EQT’s dedication to ESG provides noticeably better positioning for future growth as international regulations surrounding sustainability and corporate responsibility become more stringent.

- Institutional Support: EQT’s long-term value proposition is reinforced by the continued trust that major pension funds and institutional investors have in the company.

Although short-term volatility is to be expected, long-term trends indicate that EQT is still a wise investment option for people who have an eye toward the future.

A Sturdy Investment in a Changing Industry

EQT AB has demonstrated remarkable resilience amidst market fluctuations. Long-term investors looking to gain exposure to a vibrant and well-run investment firm may find the recent decline in share price to be concerning, but it also offers a possible entry point.

EQT AB is in a strong position to generate strong returns in the years to come thanks to a solid leadership transition, strategic expansion into high-growth industries, and a strong commitment to sustainability. Investors who want stability with room to grow should closely monitor EQT AB’s changing course.