With its volatile share price, Mosman Oil and Gas Ltd., a small but ambitious exploration and production company, has drawn the attention of investors. Mosman, which mostly operates in the US and Australia, is establishing a niche in the fields of hydrocarbons, helium, and hydrogen—three resources that are valuable now and in the future for the world’s energy industry. The company is at a turning point that could determine its financial future because of the growing demand for cleaner energy solutions and the volatility of oil prices.

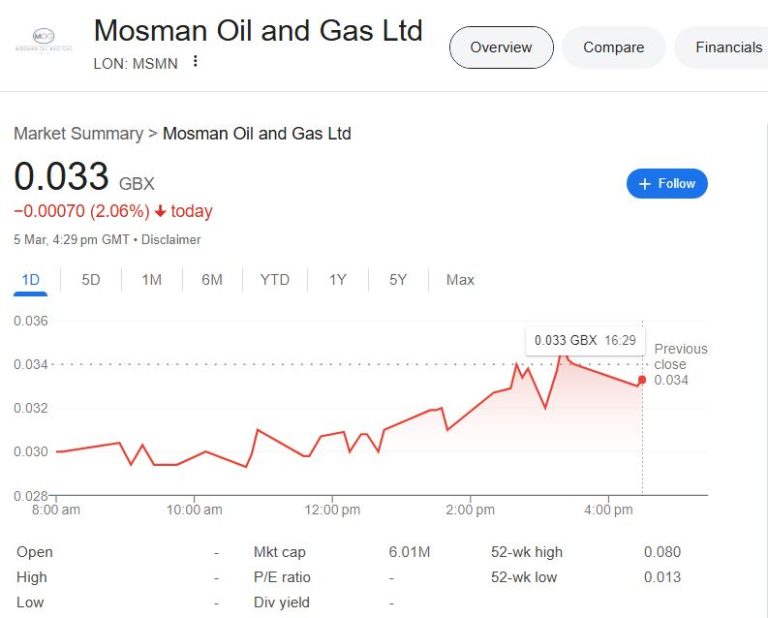

The history of the stock’s price provides an engaging narrative. It has fluctuated from a low of 0.013 GBX to a high of 0.08 GBX over the last 12 months, illustrating the difficulties small-cap companies face as well as the general unpredictability in the energy markets. The main concern for investors is whether Mosman can profit from new developments in alternative fuels and turn its exploration operations into steady income.

Key Share Price Information

| Stock Symbol | MSMN (LON) |

|---|---|

| Market Cap | £6.01M |

| 52-Week High | 0.080 GBX |

| 52-Week Low | 0.013 GBX |

| Current Price | 0.033 GBX |

| P/E Ratio | N/A |

| Dividend Yield | N/A |

| Industry | Oil & Gas Exploration and Production |

| Headquarters | Millers Point, Australia |

Handling Market Uncertainty

A combination of changes in the oil market, investor sentiment toward small-cap energy stocks, and operational developments can be blamed for Mosman’s share price swings. In the end, whether the company can overcome its erratic trading pattern will depend on its capacity to increase production, obtain capital, and form strategic alliances.

Although conventional hydrocarbon exploration is still a major aspect of Mosman’s operations, its foray into helium and hydrogen may prove to be a crucial differentiator. Given the growing demand for helium from the technology, aerospace, and medical industries as well as the growing popularity of hydrogen as a clean fuel, the company’s diversified strategy may draw in investors seeking exposure to a variety of energy markets.

Mosman’s Bet on Hydrogen and Helium

Mosman is aware of changing energy priorities, as evidenced by his strategic interest in hydrogen and helium. Since helium is becoming more and more scarce, gaining access to supplies could be beneficial. In contrast, hydrogen is generally regarded as a key component of the shift to green energy. Mosman’s stock may attract interest from investors outside of the conventional oil and gas sector if it can make significant strides in these areas.

However, money is needed to scale these operations. Investors will be closely monitoring any announcements about offtake agreements, funding rounds, or partnerships that could validate the company’s long-term strategy and offer financial stability.

Market Position and Investor Attitude

There have been conflicting market responses to Mosman’s stock. On the one hand, speculative investors looking for a quick upside find it appealing due to its low price and high volatility. However, some institutional investors have stayed out of the market due to worries about execution risks and funding difficulties.

Mosman operates in a high-risk, high-reward environment because it is an AIM-listed stock. Mosman will need to maintain investor trust through financial discipline and clear milestones, as many AIM-listed companies struggle with liquidity and market confidence.

Potential Drivers of Share Price Growth

A number of significant events could raise Mosman’s stock price:

- Production Growth: It would show operational strength to increase oil and gas production from current assets.

- Hydrogen and Helium Success: Advancements in these developing markets may draw in new capital and increase Mosman’s market value.

- Strategic Alliances: Working together with a bigger energy company may help you get the capital and know-how you need to grow.

- Market Conditions: Higher oil and gas prices would probably boost investor sentiment and increase profitability.

Is It a Long-Term Opportunity or a Speculative Bet?

Mosman offers a compelling opportunity for investors who can tolerate a certain amount of risk. The stock provides exposure to several energy sectors at a comparatively low price, despite its high level of speculation. There may be a lot of upside potential for those who think the business can scale production and get funding.

Investors should exercise caution, though. The business must successfully manage market risks while implementing its growth strategy. Patience and a clear risk management strategy are crucial because small-cap energy stocks frequently see price swings driven more by sentiment than by fundamentals.