As a powerful force in a market that has historically been dominated by mass-market brands, Fever-Tree Drinks PLC has completely transformed the premium drinks mixer sector. The company has developed a devoted global following thanks to its reputation for using natural ingredients, producing high-quality products, and using branding that appeals to affluent consumers. But like any publicly traded company, its share price varies according to market forces, consumer trends, and the state of the economy.

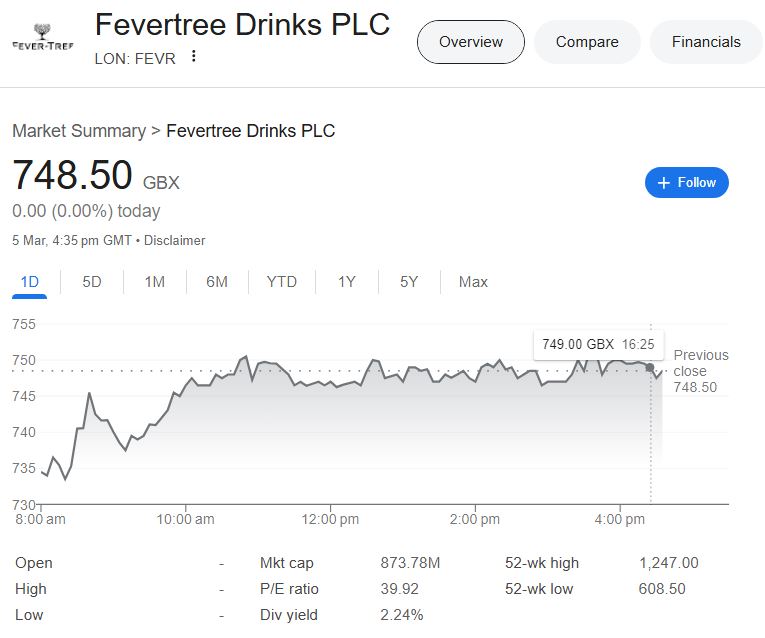

The performance of Fever-Tree’s stock over the last 12 months has shown both investor optimism and more general market difficulties. The share price, which trades under the ticker FEVR on the London Stock Exchange (LSE), has fluctuated between 608.50 GBX and 1,247.00 GBX, indicating both periods of robust growth and sporadic volatility. Even though the stock is impacted by outside variables like inflation, supply chain interruptions, and changing consumer preferences, Fever-Tree is still proving to be resilient in its industry.

Fever-Tree Share Price Overview

| Metric | Details |

|---|---|

| Ticker Symbol | FEVR |

| Stock Exchange | London Stock Exchange (LSE) |

| Current Share Price | 748.50 GBX |

| 52-Week High | 1,247.00 GBX |

| 52-Week Low | 608.50 GBX |

| Market Capitalization | £873.78M |

| P/E Ratio | 39.92 |

| Dividend Yield | 2.24% |

| Revenue (Latest) | £86.45M (June 2024) |

The Ascent of Fever-Tree to Market Leadership

Tim Warrillow and Charles Rolls founded Fever-Tree in 2004 after spotting a need for high-end drink mixers that complement fine spirits rather than overpower them. Their strategy of finding the best natural ingredients, staying away from artificial sweeteners, and promoting their products as a necessary component of high-end drinking experiences immediately struck a chord with customers and the hospitality sector.

During the global gin renaissance, when Fever-Tree tonic water became a must-have pairing for premium gins, the company’s growth was especially noteworthy. Since then, the brand’s reach has grown beyond tonic, branching out into ginger beer, soda water, and cocktail mixers, all of which have strengthened its position in the market.

Factors Affecting the Share Price of Fever-Tree

- Consumer Behavior and Economic Trends Consumer spending patterns are greatly influenced by the state of the economy, especially in the premium beverage industry. Luxury brands like Fever-Tree have to carefully balance price and value perception as inflation affects disposable income. Fever-Tree is protected from some market downturns by its position in the high-end mixer segment, even in the face of economic challenges.

- Cost and Supply Chain Stresses Fever-Tree is among the beverage companies that have been greatly impacted by the global supply chain crisis and the rising costs of raw materials. Margin pressure has come from shortages of glass bottles, higher freight costs, and rising ingredient prices. These difficulties have been lessened by the company’s strategy of increasing production efficiency and diversifying its suppliers, but investors are still cautious about potential cost implications.

- Market penetration and geographic expansion With significant market penetration in the US, Europe, and Asia-Pacific, Fever-Tree’s international expansion has been exceptionally successful. Due to the growing demand for high-end craft cocktails and non-alcoholic mixers, the U.S. market continues to show great promise. Fever-Tree’s global presence has been greatly enhanced by its partnerships with distributors and large retailers.

- Industry Cycles and Seasonal Trends Sales in the beverage industry fluctuate seasonally, peaking during the summer and the holidays. Fever-Tree has a competitive advantage due to its strong branding within the premium cocktail culture, which guarantees that its products are in demand all year long, even during off-peak times.

Does Investing in Fever-Tree Make Sense?

Whether Fever-Tree’s current share price provides value for long-term growth is the most important factor for investors. A strong basis for future profits is suggested by the company’s premium positioning, brand loyalty, and international expansion initiatives. However, when making investment decisions, one must take external economic pressures and stock price fluctuations into account.

Since investors are confident in Fever-Tree’s future profitability and market power, the company is trading at a premium to other beverage companies, as evidenced by its P/E ratio of 39.92. Additionally, shareholders looking for returns other than stock appreciation find it appealing due to its 2.24% dividend yield.

FAQs Regarding the Share Price of Fever-Tree

Is it wise to invest in Fever-Tree?

Strong brand strength, global expansion, and consumer demand for high-end mixers are the main drivers of Fever-Tree’s promising long-term growth prospects. However, when choosing an investment, short-term volatility should be taken into account.

What has caused the stock price of Fever-Tree to fluctuate recently?

Stock swings have been caused by market variables like inflation, supply chain interruptions, and economic uncertainty. Future stability depends on Fever-Tree’s capacity to adapt and maintain growth.

What is the difference between Fever-Tree and its rivals?

Fever-Tree has a distinct advantage over mass-market soft drinks because it competes in the premium mixer market. It differs from other mixer brands with its premium branding, natural ingredients, and dedication to quality.

Is Fever-Tree a dividend payer?

Indeed, investors seeking steady returns in addition to possible stock appreciation will find Fever-Tree appealing due to its 2.24% dividend yield.

What will happen to Fever-Tree next?

Fever-Tree is concentrating on growing its global presence, improving the effectiveness of its supply chain, and introducing novel products. The key to long-term success will be its expansion in the Asia-Pacific and U.S. markets.

In conclusion, this brand has a lot of potential for investment.

Fever-Tree is a major force in the beverage sector thanks to its tenacity in the market and dedication to superior quality and innovation. Even though the stock price will inevitably fluctuate in the short term, its long-term growth trajectory is still encouraging. Fever-Tree might be a desirable addition to the portfolios of investors who have faith in the future of high-end drink mixers and calculated international growth.