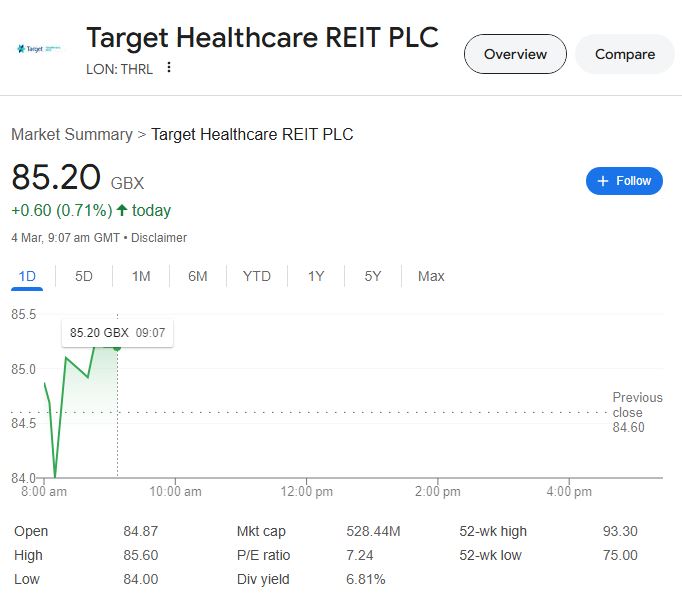

In the market, Target Healthcare REIT (THRL) has been causing a stir, especially among investors seeking long-term stability and consistent income. The company has established itself as a major force in the care home industry by concentrating on healthcare real estate, meeting the rising demand for senior living facilities in the UK. The company’s shares are currently trading at about 85.20 GBX as of early March 2025, indicating a cautious but consistent upward trend in recent months.

Examining the Market Performance of Target Healthcare

Target Healthcare’s REIT model has shown remarkable resilience in the face of wider market volatility, bolstered by its long-term leasing agreements with healthcare operators. With a 6.81% dividend yield, the company is a desirable choice for investors who prioritize income. Its 52-week trading range, which spans from 75.00 to 93.30 GBX, also emphasizes the price swings that have defined the previous year.

| Company Name | Target Healthcare REIT PLC |

|---|---|

| Stock Symbol | THRL (LSE) |

| Current Share Price | 85.20 GBX |

| Market Cap | £528.44M |

| P/E Ratio | 7.24 |

| Dividend Yield | 6.81% |

| 52-Week High | 93.30 GBX |

| 52-Week Low | 75.00 GBX |

| Sector | Real Estate Investment Trust |

| Industry | Healthcare Properties |

The Motivating Elements of Target Healthcare’s Share Price Changes

The following significant factors have affected THRL’s market performance in 2025:

- Growth in Healthcare Demand: As the UK’s population ages quickly, there is a greater need for high-quality care facilities, which increases the company’s revenue sources.

- Resilient Rental Model: By using long-term leasing agreements, the REIT ensures steady rental income and lessens the effects of recessions.

- Inflation-Linked Revenues: To guard against growing expenses, Target Healthcare has included inflation-adjusted rental uplifts in a number of its leases.

- Market sentiment regarding REITs: Interest rate uncertainty has caused volatility in the larger real estate investment trust market, which has affected share prices.

In 2025, is Target Healthcare a wise investment?

Target Healthcare makes a strong case for investors looking to preserve their capital over the long term while earning a steady income. On the other hand, some market analysts are worried about how rising interest rates will affect REIT valuations. Value investors may benefit from the company’s low P/E ratio (7.24), which indicates that the stock is still cheap when compared to its industry peers.

Target Healthcare in Relation to Other REITs

When evaluating dividend-focused healthcare REITs, investors frequently contrast THRL with Impact Healthcare REIT (IHR) and Primary Health Properties (PHP). Given the demographic trends, THRL’s focus on care homes presents greater long-term growth potential than PHP, which keeps a more diversified healthcare portfolio.

Prospects for Future Growth and Hazards

What will happen to Target Healthcare next?

- Growth into New Properties: It is anticipated that the business will buy more assisted living facilities, boosting its portfolio of properties and rental revenue.

- Interest Rate Sensitivity: Investors must keep a careful eye on macroeconomic conditions because REITs may see valuation swings if the Bank of England modifies interest rates.

- Policy and Regulation Risks: Modifications to UK healthcare laws may have an effect on the financial stability and profitability of assisted living facilities.

Analyst Forecasts and Market Prospects

Regarding Target Healthcare’s future, financial analysts are cautiously optimistic. Many predict that, under the assumption of steady market conditions and ongoing rental growth, its share price could rise to the 90–95 GBX range in the upcoming 12–18 months.

Dividend Stability: A Significant Benefit

Target Healthcare is a notable option for dividend investors due to its steady payout. For income-focused portfolios, its quarterly dividend payments offer consistent income, which is a crucial component. Considering the company’s historically steady cash flows, the 6.81% yield is still appealing.

Important Lessons for Investors

Strong Growth Potential: Long-term revenue growth is supported by the growing demand for care facilities.

- Attractive Dividend Yield: Income investors are drawn to a steady 6.81% return.

- Market Resilience: THRL is still a defensive stock with solid fundamentals in spite of interest rate swings.

- Opportunity for Valuation: Given the low P/E ratio, there may still be a chance to purchase the stock at a discount.

Is Target Healthcare a Good Investment to Make?

Target Healthcare REIT is a well-rounded option for investors seeking stability in erratic markets. The business’s revenue-generating portfolio and strategic positioning in the healthcare industry offer a solid basis for long-term returns, despite market risks. As always, before deciding to invest, potential investors should keep a careful eye on company performance, interest rate changes, and market trends.