Snapchat has never been a rule-abiding business. It has consistently reinvented itself, resisted intense competition, and defied expectations since its initial public offering. Investors are still perplexed by its stock, though, as it fluctuates between periods of optimism and uncertainty.

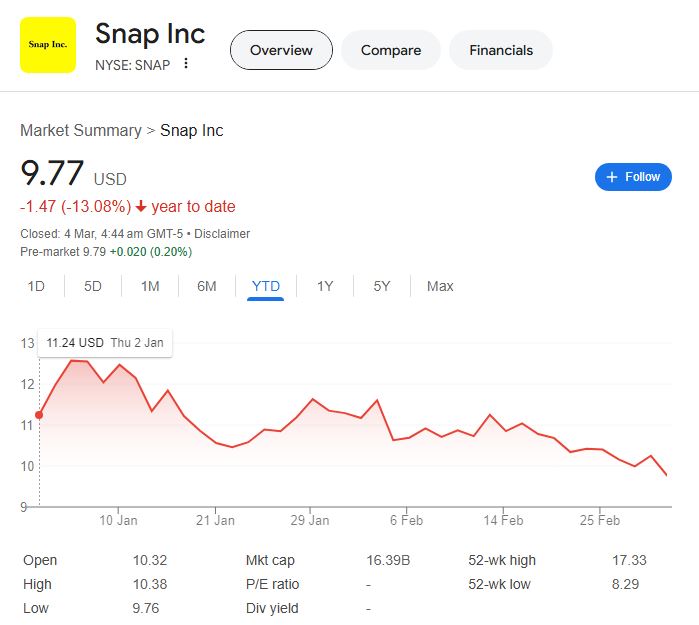

A far cry from its 52-week peak of $17.33, Snapchat’s share price has been circling around $9.77 in recent weeks. Some see it as an undervalued tech stock with substantial potential for growth, while others see it as a business that is having difficulty establishing itself in the fiercely competitive digital market.

Snapchat (SNAP) Stock Key Insights

| Metric | Value |

|---|---|

| Stock Price (March 2025) | $9.77 |

| Market Cap | $16.39 billion |

| 52-Week High | $17.33 |

| 52-Week Low | $8.29 |

| P/E Ratio | N/A (Not Profitable) |

| Quarterly Revenue (Q4 2024) | $1.56 billion |

| Net Income (Q4 2024) | $9.1 million |

| Beta (Volatility Measure) | 0.92 |

| Dividend Yield | None |

| Next Earnings Date | April 2025 |

Is It Time to Buy the Dip After SNAP Stock Takes a Hit?

Although the price of Snapchat’s stock has recently dropped, experienced investors are aware that volatility frequently presents opportunities. Could this be a wise starting point for future profits?

Why Snapchat’s Stock Volatility Is Unpredictable and What It Signifies for Investors

One of the most erratic tech stocks is SNAP. Does this volatility indicate underlying instability or is it a sign of potential growth?

What Snapchat Is Missing from the Market

Although a lot of people concentrate on the company’s recent losses, some important signs point to the possibility that Snapchat is getting ready for a big comeback.

Who Will Win the Social Media War Between Snapchat, TikTok, and Meta?

Digital behemoths are a constant threat to Snapchat. Does it possess the strategic vision, user loyalty, and innovation necessary to establish a lucrative niche?

Augmented reality and artificial intelligence: the technologies that could save SNAP

Snapchat is making significant investments in AR filters and AI-powered suggestions. Could these developments lead to an increase in ad revenue and user engagement?

Snapchat’s Future Could Be Affected by This One Financial Metric

Investors should be keeping an eye on this single financial indicator, which has the potential to determine the stock’s long-term success. Forget about daily active users.

Is It Possible for Snapchat to Turn a Profit?

Snapchat is still losing money even with its impressive revenue figures. What needs to change for it to generate steady profits, and how near is it to turning a corner?

Is Snapchat a Target for a Buyout? Analysts’ Opinions

Tech companies are always searching for new partners. Could Snapchat be the next big acquisition for Google, Apple, or even Meta?

The Hidden Weapon of Snapchat

Snapchat is increasingly concentrating on AR. Could this be the innovation that sets it apart from the rest of the pack?

In 2025, where will SNAP’s stock be? Expert Opinions

The future of Snapchat is still up in the air. Is its stock price destined to stay below $10 or will it rise above $20?

What Causes the High Volatility of Snapchat’s Stock?

SNAP has consistently been a high-risk, high-reward stock for investors. Snap lacks a diverse product line and a proven ad revenue model, in contrast to Meta or Google. Rather, it depends nearly exclusively on digital advertising, a field that has been significantly impacted by Apple’s iOS privacy modifications.

What’s interesting, though, is that Snapchat keeps coming up with new ideas in spite of these obstacles. With the potential to greatly increase engagement and revenue, the company is making significant investments in creator partnerships, immersive AR content, and AI-driven ad placements.

Snapchat’s younger user base is among the most ignored aspects. Snapchat has a devoted following of very active users, whereas TikTok appeals to Gen Z and Meta tends to be older. The business may be able to achieve profitability if it can figure out how to better monetize this audience.

The Profitability Conundrum: Is SNAP Profitable?

Investors shouldn’t get too excited just yet, even though Snap’s most recent earnings report showed a modest $9.1 million profit. The business continues to struggle with profitability and severe cost pressures.

For Snapchat to be successful in the long run, it needs to:

To compete with Meta and TikTok, it should improve its ad revenue model. It should also increase its monetization efforts by introducing creator tools, premium content, and augmented reality shopping. Reduce operating expenses without sacrificing expansion.

Analysts continue to disagree despite CEO Evan Spiegel’s repeated emphasis on Snapchat’s long-term goals. While some believe a business is poised for a resurgence, others fear it may fall behind in the social media competition.

In 2025, is it wise to purchase Snapchat stock?

Your investment strategy will determine the answer.

📌 Snapchat has enormous growth potential for risk-tolerant investors, but only if it can successfully implement its AI and AR strategies.

📌 The volatility of SNAP remains too high for conservative investors. In contrast to well-known tech behemoths, Snapchat has no history of steady profitability.

📌 For ardent supporters, Snap’s robust brand, youthful user base, and state-of-the-art technology may establish it as a future leader in digital experiences and social commerce.

How to Make Sensible SNAP Investments

✔️ Keep an eye on the upcoming earnings report—the company’s course will be determined in large part by April 2025.

✔️ Track user engagement patterns—revenue per user is a more significant factor than daily active users (DAUs).

✔️ Keep an eye on changes in ad revenue; if Snap’s AI-powered ad placements prove successful, the stock may experience a notable surge in value.

✔️ Diversify your investments—SNAP shouldn’t be your whole wager, but rather a component of a well-rounded tech investment strategy.

Is a Breakthrough on the Horizon for Snapchat?

Snapchat is at a turning point in its history. Even though it is still losing money, its investments in e-commerce, AI, and AR may help it succeed in the long run. This is an uphill battle, though, because TikTok and Meta are more competitive than ever.

If SNAP can convert engagement into revenue, it could be a long-term winner for risk-taking investors. In any case, this stock will be worth keeping an eye on during the crucial next 12 months. 📈 🚀