For years, investor discussions have revolved mostly on BP, a massive worldwide energy company. BP’s share price is negotiating both promise and uncertainty as oil markets swing and renewables gather traction. The important question now is when to start investing?

The stock performance of the company has shown resilience, juggling possibilities in oil, gas, and renewable energy with the difficulties of energy changes. Viewing BP’s dividend yields and long-term growth potential, investors are debating whether this is the perfect time to buy or if prudence is justified.

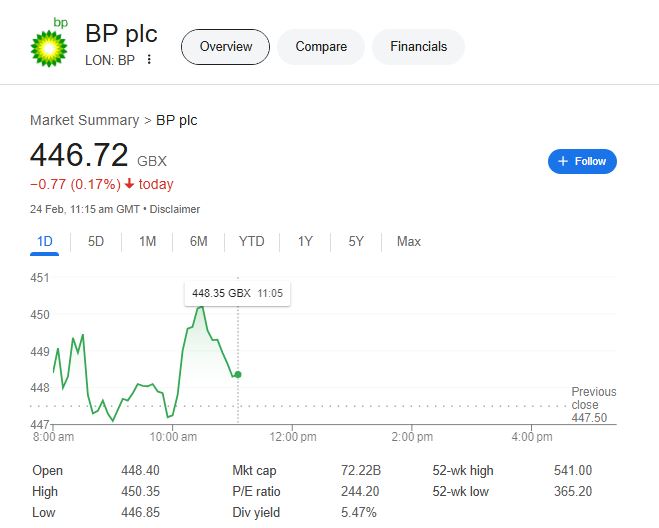

BP Share Price: Key Financial Metrics & Market Overview

| Metric | BP plc (2024) |

|---|---|

| Current Price | 448.35 GBX |

| Market Cap | £72.22B |

| P/E Ratio | 244.20 |

| Dividend Yield | 5.47% |

| 52-Week High | 541.00 GBX |

| 52-Week Low | 365.20 GBX |

Strengths of BP: One Stock Designed for the Future

- Strong Dividend Yield Long-term investors should still find great attraction in BP’s 5.47% dividend yield. Consistent dividend payments give dependable income in a time when market volatility generates uncertainty.

- Increasing Energy Investments The pledge of BP to net-zero emissions by 2050 points to a radical change. Investing heavily in offshore wind farms, solar projects, hydrogen energy, BP is moving outside conventional oil output.

- Leader in the global market and oil resilience Operating in more than 70 countries, BP boasts a large infrastructure that guarantees consistent income even in recessionary times. Oil demand is still strong even if renewable energy sources are expanding; BP’s varied portfolio helps to balance risk and reward.

Risks and Challenges: Will the Share Price of BP Maintain Its Momentum?

- Changing Oil Demand and Climate Control Policies Long term, the drive for renewable energy and electric cars could strain BP’s income sources. The company is diversifying, but its main business—which exposes it to changes in world energy consumption—is still oil.

- High Value and Variable Market BP’s valuation calls questions with a P/E ratio of 244.20. Its earnings increase might not be sufficient to support its present stock price when compared to industry peers. Is BP overpriced? Many analysts are arguing about that.

- Contest from Green Energy Companies Giants of renewable energy like Ørsted and NextEra Energy compete fiercely with BP. Closely observing BP’s development are investors wondering whether its switch to renewable energy will be quick enough.

BP Share Price Prediction: What’s Next for 2025?

Forecasting BP’s stock performance isn’t straightforward, but analysts are providing insights into potential price trends.

| Year | Projected BP Share Price |

|---|---|

| 2024 | 450 – 520 GBX |

| 2025 | 480 – 550 GBX |

| 2026 | 500 – 580 GBX |

🔎 Source: Industry expert forecasts from Yahoo Finance & Bloomberg.

Is BP a Buy, Hold, or Sell in 2024?

- ✅ BUY BP if you:

- Want a high-yield dividend stock with global energy dominance.

- Believe BP’s renewable energy expansion will drive future growth.

- Expect oil prices to remain steady, supporting BP’s core business.

- ❌ AVOID BP if you:

- Fear declining oil consumption will impact long-term earnings.

- Think BP’s high valuation outweighs its potential returns.

- Prefer pure renewable energy stocks over traditional oil companies.

Ultimately, will the share price of BP keep rising?

BP finds itself at a crossroads juggling conventional oil activities with increasing emphasis on renewable energy. Strong dividend yields and worldwide dominance appeal, but market volatility and regulatory risks call for caution.

BP stays a good stock for investors looking for consistent income with exposure to energy transformation. Are you ready to make the leap?

BP Share Price: Often Asked Questions

- Is a strong long-term investment BP stock offers? The future of BP relies on its ability to fit the energy change. Should it effectively balance green energy with fossil fuels, it could present high long-term profits.

- 2024’s dividend payout from BP? With a 5.47% dividend yield right now, BP appeals to those looking for income.

- Why is stock price of BP varying? BP’s stock movement is influenced in part by market forces including oil price volatility, world economic conditions, and climate policies.

- How does BP plan to incorporate renewable energy? While increasing solar, wind, and hydrogen investments, BP wants to cut the output of fossil fuels by forty percent by 2030.

- Should I buy BP shares now or wait? Now could be the right moment if you think BP can lead in green energy. Still, pay close attention to market trends before acting.