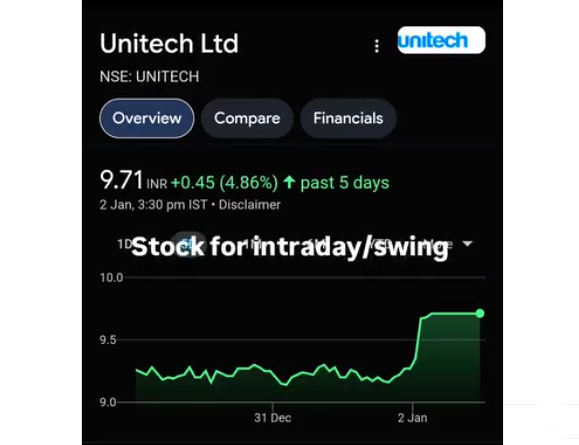

Unitech Limited, which was once acclaimed as the biggest real estate developer in India, has experienced a range of fortunes, from aspirations to build high-rises to courtroom drama and financial collapse. However, as of May 20, 2025, the Unitech share price quietly hovers around ₹6.47 despite declining revenue and previous controversies. Although that may appear modest, experienced investors interpret it as a sign of something more complex: a stock that may be undervalued while undergoing a laborious reinvention.

| Company Name | Unitech Limited |

|---|---|

| Current Share Price (as of May 20, 2025) | ₹6.47 |

| Founder | Ramesh Chandra |

| Executive Chairman | Yudhvir Malik |

| Founded | 1972 |

| Headquarters | New Delhi, India |

| Traded On | BSE: 507878, NSE: UNITECH |

| Employees | 400+ (as of 2021) |

| Revenue (FY23) | ₹491.95 crore |

| Net Income (FY23) | ₹−2,787.67 crore |

| Total Assets (FY23) | ₹26,885.56 crore |

| Total Equity (FY23) | ₹−1,139.92 crore |

| Reference | unitechgroup.com |

Unitech has been trying a slow but increasingly intentional turnaround by strategically concentrating on asset restructuring and core real estate development. The company seems to be heading toward cautious but disciplined growth with significant leadership changes, most notably the appointment of Yudhvir Malik as Executive Chairman. Observers of the market are now assessing its future rather than just responding to its past.

At first look, Unitech’s consistent but modest stock movement in recent days might not seem noteworthy. However, it depicts a company stabilizing following years of upheaval for analysts. Long shadows are still cast by the legal setbacks from the 2G spectrum scandal, which seriously damaged investor confidence. Nonetheless, governance frameworks and operational accountability have significantly improved as a result of the post-scandal corrective actions.

Unitech is strategically reinvesting in residential developments with comparatively lower risk by utilizing its historically robust land bank and concentrating on urban areas like Noida, Gurgaon, and Bangalore. Despite being cautious, this change is especially advantageous in light of India’s growing need for affordable housing. Once-struggling companies like Unitech now have the frameworks in place to operate with renewed credibility as new real estate regulations drive transparency.

In an industry where delays can severely impair cash flow, Unitech is cutting project timelines through strategic alliances with regional contractors and modular construction companies. A particularly creative move in a post-RERA market, the company’s asset-light partnerships also provide flexibility without the burdens of excessive leverage.

However, the data presents a nuanced picture. The road ahead is unquestionably steep, with total equity still in negative territory and a net loss of ₹2,787 crore in FY23. However, the significant increase in total assets and the rise in operating income to ₹53.61 crore point to underlying resilience. Today’s Unitech bettors are spotting early signs of recalibration rather than chasing after bygone glory.

In light of more general real estate trends, Unitech’s story is similar to that of other Indian legacy developers looking to turn their fortunes around. The business has experienced legal disputes, consumer mistrust, and liquidity shortages, much like Jaypee Infratech or Amrapali. But in contrast to some of its competitors, Unitech has maintained a diverse asset base and brand awareness, particularly in North India.

Unitech’s low entry point makes it surprisingly affordable for contrarians or early-stage investors to own a portion of a business with a vast portfolio. Although it’s not a stock with immediate momentum, it has significant long-term growth potential, especially if debt is further reduced and important projects are finished. This makes the share a silent test case for the effects of regulatory reform on struggling companies in addition to being a recovery play.

Unitech is attempting to resolve outstanding housing handovers, a problem that has historically damaged its reputation, by working closely with regulatory agencies and concentrating on consumer redressal. Every project that is finished and every possession letter that is turned over represents not only a significant business achievement but also a change in public perception. And restoring market value can be remarkably successful when trust is gradually restored.

But institutional investors still need to exercise caution. Expect volatility, particularly in reaction to judicial updates and quarterly filings. However, that same volatility also presents an opportunity, particularly if the business surprises the market with better asset monetization or execution. Such tactical victories have the potential to drastically change sentiment in the upcoming years.