Hellenic Net Banking has quietly emerged as one of the most dependable pillars for Greek companies amidst the tumultuous wave of Europe’s digital revolution. Efficiency isn’t just promised—it’s executed perfectly in Hellenic Bank’s digital ecosystem, which features a particularly inventive yet remarkably user-friendly platform. This goes beyond simply checking balances and transferring money. It’s about giving companies the ability to automate, streamline, and take charge with the simplicity of using a dashboard as responsive and spotless as the interior of a contemporary electric vehicle.

The system is an exceptionally powerful force multiplier, especially for SMEs. Hellenic Net Banking has made the daily grind a digital breeze by centralizing bulk payment functionality, real-time reports, user management, and account access. Greek business owners have been using this platform more and more in recent years to support strategic decision-making as well as to manage everyday financial tasks. Banking has evolved into business intelligence encased in security measures.

Core Features of Hellenic Net Banking for Business

| Feature | Description |

|---|---|

| Alerts & Notifications | Real-time updates via SMS/email on balances, movements, and flagged actions |

| Security Architecture | Single-device login, encryption, auto-timeouts, multi-step authentication |

| Payroll Processing | Templates for recurring payments; streamlined setup and approvals |

| Multi-Payment Capabilities | Upload files from accounting software for bulk domestic/international transfers |

| Role-Based Access Control | Assign user roles with clear permission levels and audit-ready transparency |

| Custom Reporting Tools | Schedule movement summaries and daily reconciliation reports |

| API Integration Suite | Developer access for embedding banking features within custom systems |

| DigiPIN Requirements | Required for new payees; waived for registered accounts and internal transfers |

| Customer Support Lines | 8000 9999 (local) / +357 22500500 (abroad) |

| Official Website | hellenicbank.com , Instagram |

Banking as an ally for business, not a hindrance

Operational speed frequently determines whether medium-sized businesses and growing startups can gain traction or lose it to bureaucratic red tape. The incredibly adaptable platform of Hellenic Bank removes typical hiccups in daily banking. The platform transforms traditionally inflexible financial workflows into flexible systems that react instantly to changing business requirements by enabling users to pre-define multiple roles—from finance interns to CFOs—and assign specific responsibilities.

This method closely resembles a contemporary project management app in many aspects, including instant audit trails, real-time visibility, and clear permissions. Teams that need to act fast while maintaining internal compliance will especially benefit from these features. The platform gains tremendous versatility by incorporating API-based services, which easily integrate with accounting software tailored to a particular industry or enterprise resource planning tools.

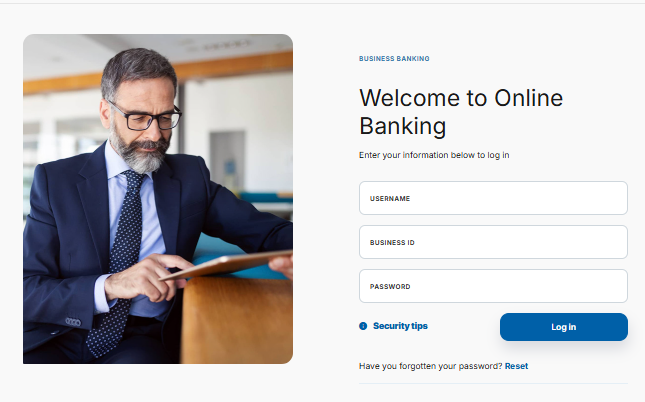

Prioritizing security while designing for usability

In a digital age where cyber threats are on the rise, convenience is frequently regarded with suspicion. However, Hellenic Net Banking has created a system that harmoniously blends usability and security. Allowing access from a single device at a time may seem restrictive, but in reality, it’s a very dependable security measure that significantly lowers vulnerability to malicious third-party logins. Time-sensitive logouts, end-to-end encryption, and required multi-factor authentication procedures all serve to reinforce this.

Bypassing certain verification layers in transactions involving registered payees or intra-company accounts, process friction is greatly decreased without sacrificing security. In addition to being effective, this adaptive security model fosters trust. Companies are aware that their data is protected, but when speed is crucial, they are not burdened by unnecessary steps.

Designed with the Greek Business Mindset in Mind

Hellenic Net Banking has become ingrained in Greek businesses’ daily routines by adapting its tools to local business practices and regional regulatory standards. Whether you’re a freight manager creating personalized transaction reports prior to a tax audit or a restaurant uploading payroll on a Thursday night, the platform is designed to work with your schedule, not the other way around.

When month-end deadlines are approaching, its scheduled reports and reconciliation summaries come in especially handy, enabling finance managers to compare cash movement data with bank statements with remarkable clarity. By doing this, human error and book closing time are decreased, freeing up resources for strategic planning instead of tedious administrative work.

Greek Finance’s Future-Proofing One Company at a Time

Platforms such as Hellenic Net Banking will become essential, not optional, as Greek businesses deal with heightened competition, narrower margins, and faster economic cycles in the years to come. Its architecture foresees the increasing demand for cross-platform integration, automated compliance, and real-time decision-making. The platform turns banking from a necessary function into a highly effective digital toolset through strategic innovation.

Hellenic Bank is quietly creating a financial framework that is appropriate for contemporary Greek business by incorporating AI-ready APIs, providing simplified user controls, and keeping a laser-like focus on cybersecurity. It’s a platform that comprehends the mindset of an entrepreneur—organized yet adaptable, aspirational yet realistic.

Hellenic Net Banking does more than just meet modern demands. It equips companies to handle the complexity of the future. This platform may be among the most progressive financial instruments on the market right now in an area renowned for its tenacity. It is also catalytic, not just supportive, for those who are prepared to scale.