For many years, gold has been seen as a safe haven asset that attracts investors looking for security during erratic times. One of the top gold miners in the world, AngloGold Ashanti, is situated at the nexus of investor sentiment and market forces driven by commodities. However, is its stock a risky gamble or a great opportunity?

Analysts and investors continue to focus on AngloGold Ashanti’s stock price due to rising inflation, shifting global demand for gold, and fluctuating interest rates. Although the company’s extensive mining operations on several continents offer a strong production base, issues like operational costs, regulatory barriers, and geopolitical risks still influence its valuation.

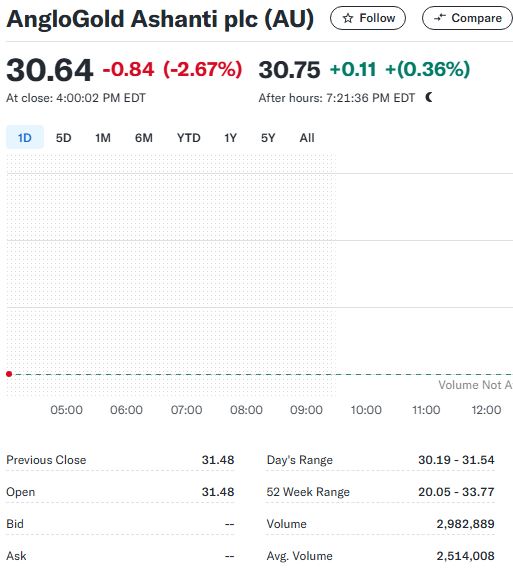

AngloGold Ashanti: Key Stock Market Data (2024)

| Metric | Details |

|---|---|

| Current Share Price | $30.64 (as of March 10, 2024) |

| 52-Week Range | $20.05 – $33.77 |

| Market Cap | $15.85 billion |

| PE Ratio (TTM) | 13.15 |

| EPS (TTM) | $2.33 |

| Dividend Yield | 4.50% |

| Beta (5Y Monthly) | 0.92 |

| Ex-Dividend Date | March 14, 2025 |

| 1-Year Target Estimate | $34.00 |

| Stock Exchange | NYSE, JSE, ASX |

Will AngloGold Ashanti’s Stock Continue to Rise or Will It Dip?

The volatility of the gold industry is reflected in AngloGold Ashanti’s share price, which has fluctuated between $20.05 and $33.77 over the last 12 months. Strong gold prices, heightened investor confidence, and calculated corporate actions have all contributed to its recent stabilization at $30.64.

AngloGold Ashanti has profited from increased demand for precious metals in the face of inflationary pressures and a declining dollar. Gold mining stocks typically rise during uncertain economic times. Its exposure to emerging markets, operational expenses, and changing central bank policies, however, continue to be significant factors influencing the movement of its stock.

The Reasons Behind Investor Interest in AngloGold Ashanti’s Stock

1. Gold’s Increasing Worth as a Secure Investment

Investors have flocked to gold-backed assets due to the ongoing inflation and impending economic uncertainty, which has increased demand for gold mining stocks like AngloGold Ashanti.

- Expansion of Strategic Mining In order to ensure a variety of revenue streams and reduce the risks associated with regional instability or regulatory changes, the company has been increasing its presence in important mining regions.

- Appealing Dividend Rate AngloGold Ashanti is a good choice for investors who are interested in income because it offers a 4.50% dividend yield, in contrast to many mining companies that heavily reinvest in operations.

- Robust Financial Results Cost-cutting measures and operational efficiencies help the company maintain strong earnings despite rising operating costs. With a PE ratio of 13.15, it appears to be reasonably priced in relation to its peers, making it a good starting point for novice investors.

The Hazards: What Might Affect the Price of AngloGold Ashanti’s Stock?

🔻 Gold Price Fluctuations: AngloGold Ashanti’s stock is directly correlated with gold prices because it is a gold producer. Investor excitement may be tempered by an abrupt decline in the demand for gold or an increase in interest rates.

Risks related to geopolitics and regulations AngloGold Ashanti, which operates in South America, Australia, and Africa, could experience disruptions as a result of labor disputes, tax changes, or governmental policies.

🔻 Growing Operational Costs: Mining profitability is still under pressure from rising energy prices, labor expenses, and environmental compliance regulations.

🔻 Currency Volatility: Because of its global reach, currency fluctuations can have an effect on revenue and profitability, especially in emerging markets.

Feelings of Investors: Should I Buy, Hold, or Sell?

📈 Bullish Case: An Extended Invest in the Strength of Gold

In spite of inflation and unstable economic conditions, gold has been steadily increasing in value, and many investors think this trend will continue. AngloGold Ashanti is a good choice for long-term investors looking to gain exposure to the gold market because of its robust production capacity, consistent dividends, and global reach.

📉 Bearish Situation: A Cyclical High with Dangers Upcoming

The recent gold rally may not be sustainable, according to some analysts. AngloGold Ashanti’s stock price may be impacted by a drop in gold prices if economic conditions stabilize and interest rates continue to rise. Operational expenses and geopolitical risks are still issues.

📊 Maintaining a Steady Position While Observing the Market

Waiting for a possible price decline before purchasing additional shares may be the best course of action for investors seeking a safer entry point. Although AngloGold Ashanti’s fundamentals are still sound, market volatility may present better opportunities for purchases.

Conclusion: Is It Wise to Invest in AngloGold Ashanti?

The stock of AngloGold Ashanti offers a well-balanced combination of risk and opportunity. On the one hand, it provides solid financial standing, growing gold prices, and robust dividends. On the other hand, it has to contend with currency risks, geopolitical difficulties, and the volatility of gold markets.

AngloGold Ashanti is a strong investment with a track record that appeals to investors who think gold will hold up over time. Waiting for a market correction, however, might offer a more alluring entry point for investors who are worried about short-term volatility.

💬 How do you feel about the share price of AngloGold Ashanti? Would you sell, buy, or hold? Leave a comment below with your thoughts!